will capital gains tax increase in 2021 uk

Will capital gains tax increase at Budget 2021. This will increase the amount you can earn tax-free.

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

The white paper on Capital Gains Tax is still live and changes to the Inheritance Tax regime are.

. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Idaho state capital gains tax rate 2021 Sunday February 27 2022 Edit.

Corporation tax and capital gains tax are central to the governments plan to help address the deficit that is on its way to 400bn 559bn this year. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The capital gains tax allowance in 2022-23 is 12300 the same as it was in 2021-22.

You only have to pay capital gains tax on certain assets and do not have to pay it at all if your gains are under your tax free allowance which is 12300 or. 20 on assets and property. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Long-term capital gains taxes are assessed if you sell investments. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg. The changes in tax rates could be as follows.

This could result in a significant increase in CGT rates if this recommendation is implemented. Its time to increase taxes on capital gains. Labour has indicated it would increase taxes on earnings made from.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a. 0754 Fri Oct 29 2021 UPDATED. First deduct the Capital Gains tax-free allowance from your taxable gain.

Chancellor Rishi Sunak swerved making any major changes to the tax people pay when they sell assets such as a second home or shares. Strict restrictions for unvaccinated come into effect in Greece. CGT allowance for 2022-23 and 2021-22.

Proposed changes to Capital Gains Tax. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

0755 Fri Oct 29. 2021 to 2022 2020 to 2021 2019 to 2020 2018 to 2019. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property from 6 April 2015. 10 on assets 18 on property. Add this to your taxable.

What the property tax rate is. Would the rate increase only take place from a future tax year eg. Once again no change to CGT rates was announced which actually came as no surprise.

In his autumn Budget. Or could the tax rate be retroactively applied to the 202122 tax year. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

As announced at Budget the government will introduce legislation in Finance Bill 2021 that maintains the current Capital Gains Tax annual exempt amount at its present level of. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. In the budget announced on Wednesday he revealed corporation tax will increase from 19 to 25 in 2023.

0400 Sun Oct 24 2021. The 3tn windfall from soaring house prices in the past 20 years should be subject to a capital gains levy so that poorer households can. When an investor sells a stock for more than the purchase price the investor experiences a capital.

OTS proposals suggested bringing Capital Gains Tax in line with Income Tax currently charged at a basic rate of 20 percent and rising to 40 percent for higher rate taxpayers. By Katey Pigden 27th October 2021 347 pm. UK records 44917 new cases.

This is called entrepreneurs relief. Capital gains tax is paid on the profits you make when you sell something - if it exceeds your tax-free allowance and losses from previous years. CAPITAL GAINS TAX is likely to increase and there could be major implications for some Britons an expert has warned ahead of the Chancellor Rishi Sunaks Budget.

The maximum UK tax rate for capital gains on property is currently 28. Tue 26 Oct 2021 1157 EDT First published on.

Tax Advantages For Donor Advised Funds Nptrust

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Dividend Tax Rates In 2021 And 2022 The Motley Fool

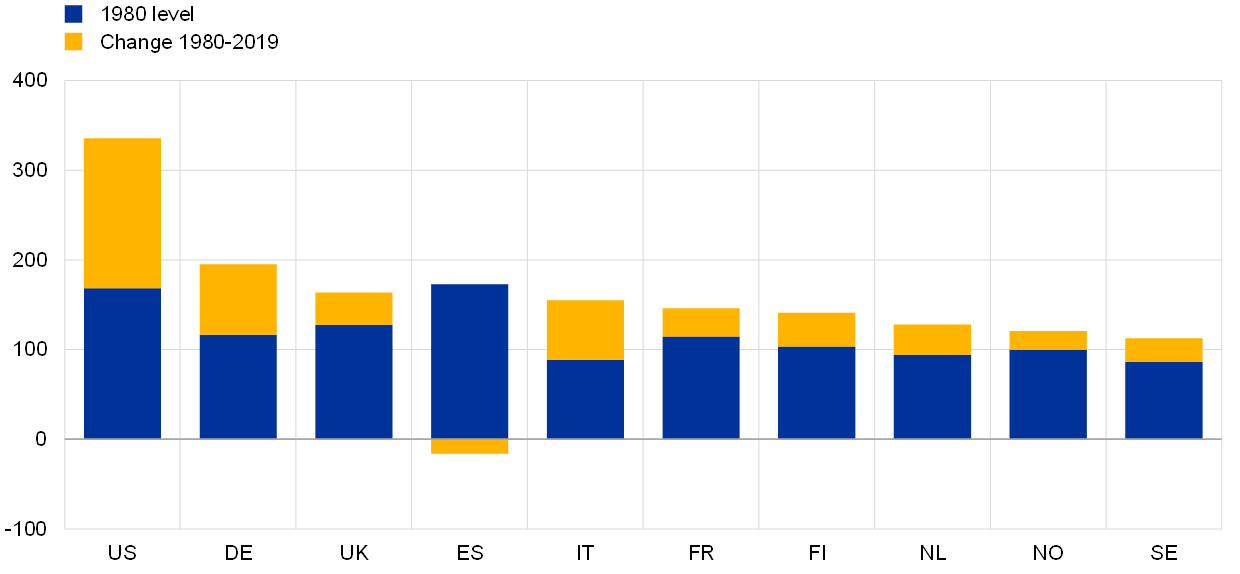

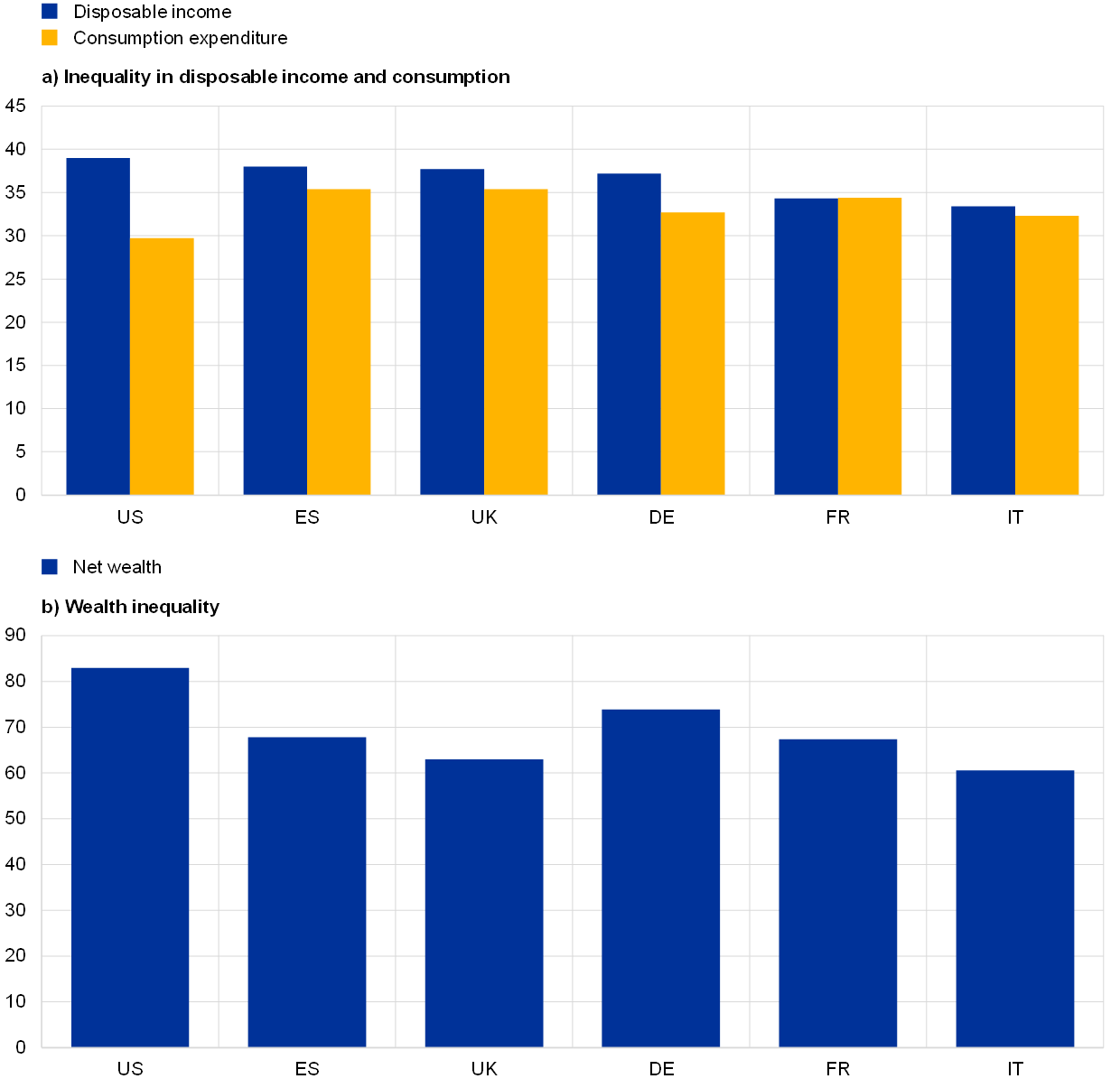

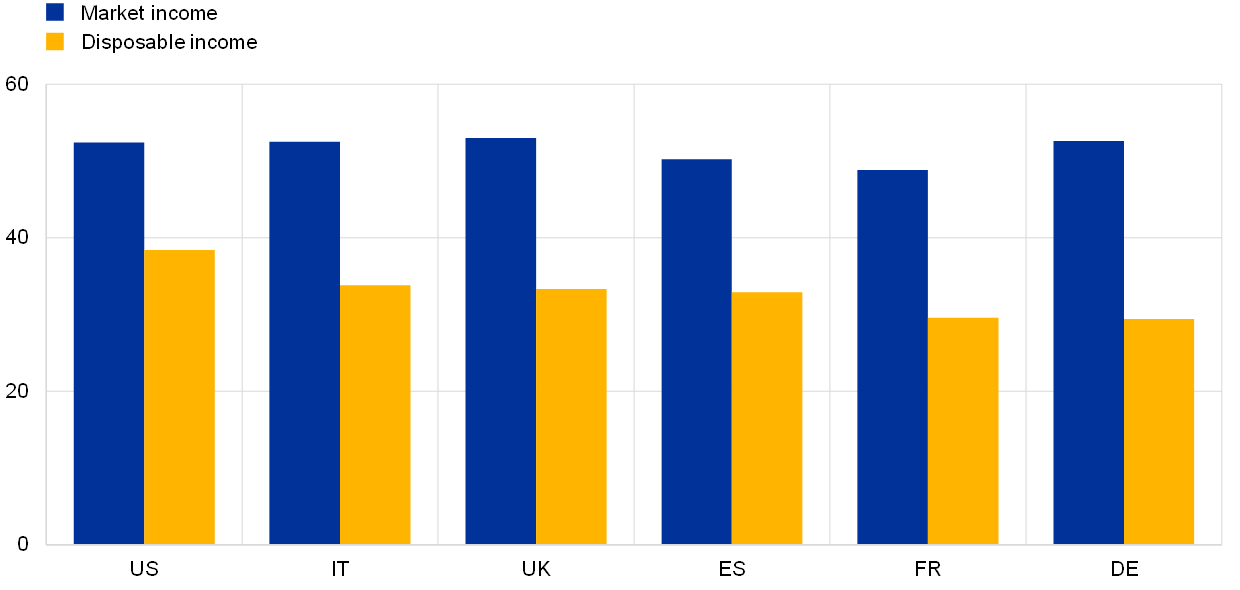

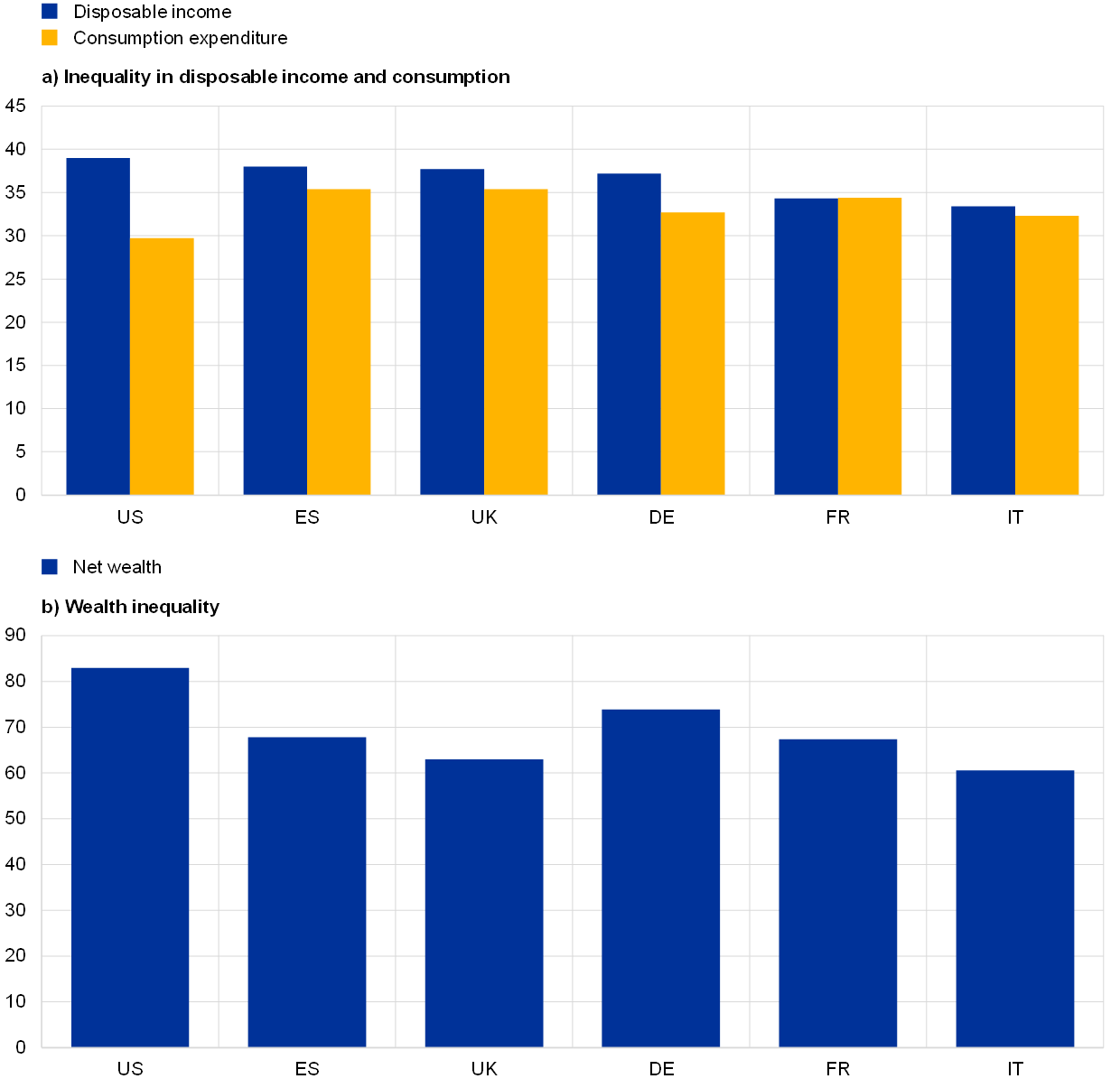

Monetary Policy And Inequality

Monetary Policy And Inequality

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor

Tax Relief Statistics December 2021 Gov Uk

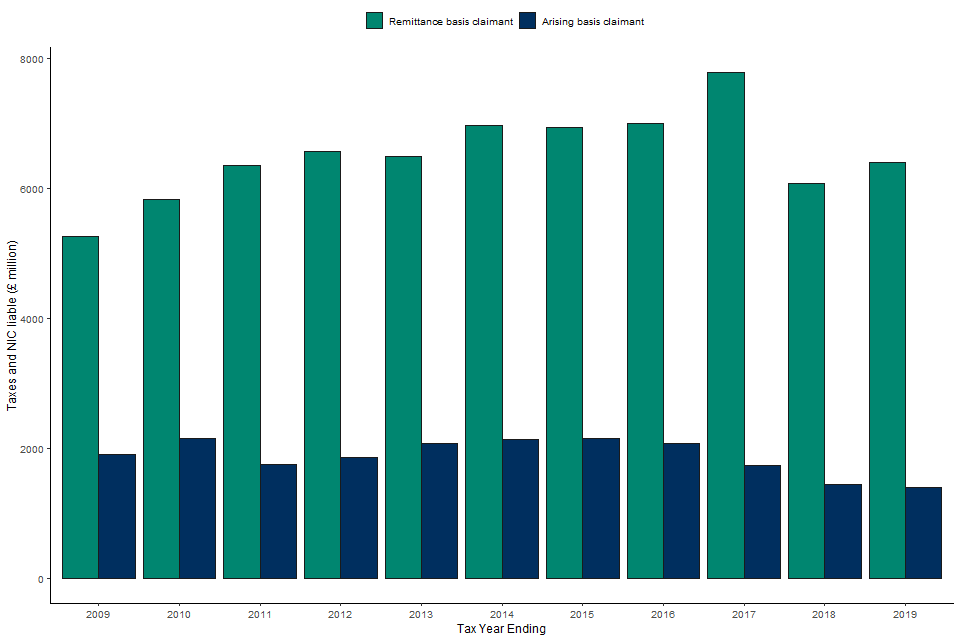

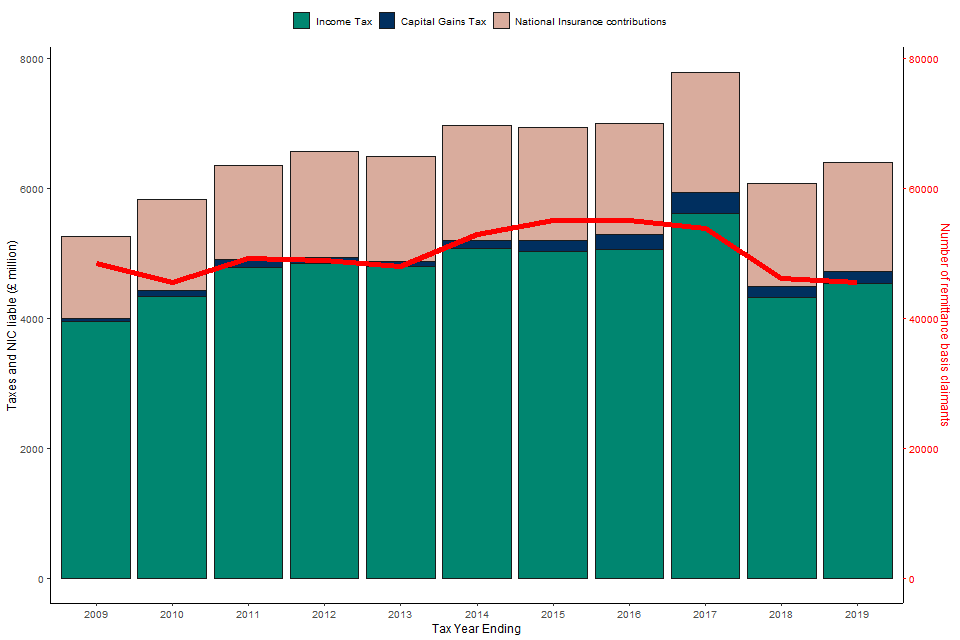

Statistical Commentary On Non Domiciled Taxpayers In The Uk Gov Uk

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Selling Stock How Capital Gains Are Taxed The Motley Fool

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

What Are Capital Gains Tax Rates In Uk Taxscouts

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Progressive Tax Explained Raisin Uk

Capital Gains Tax On Gold Gold Co Uk

Statistical Commentary On Non Domiciled Taxpayers In The Uk Gov Uk

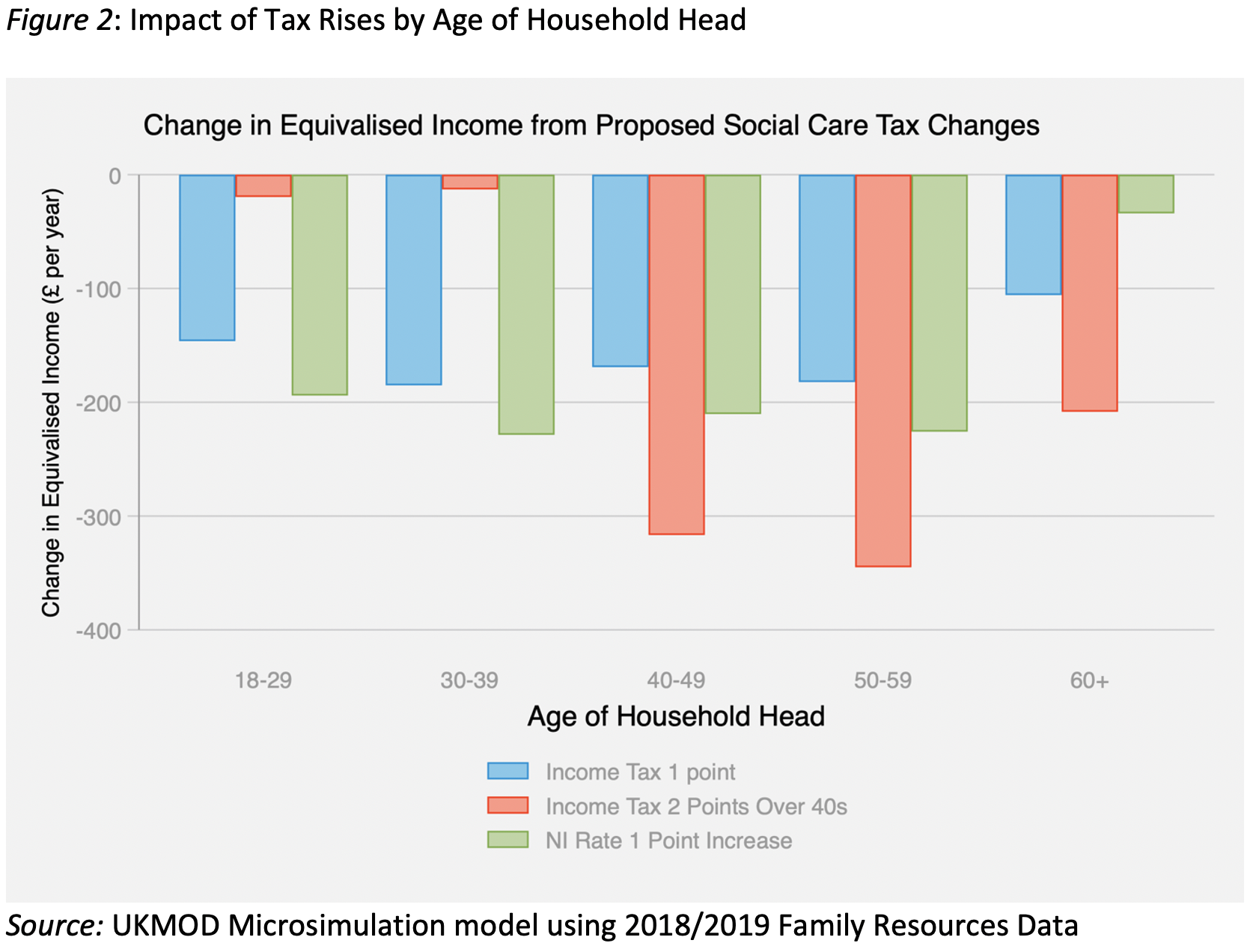

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group